Interest rated to become five times as high

How does the increased interest rate affect your student loans?

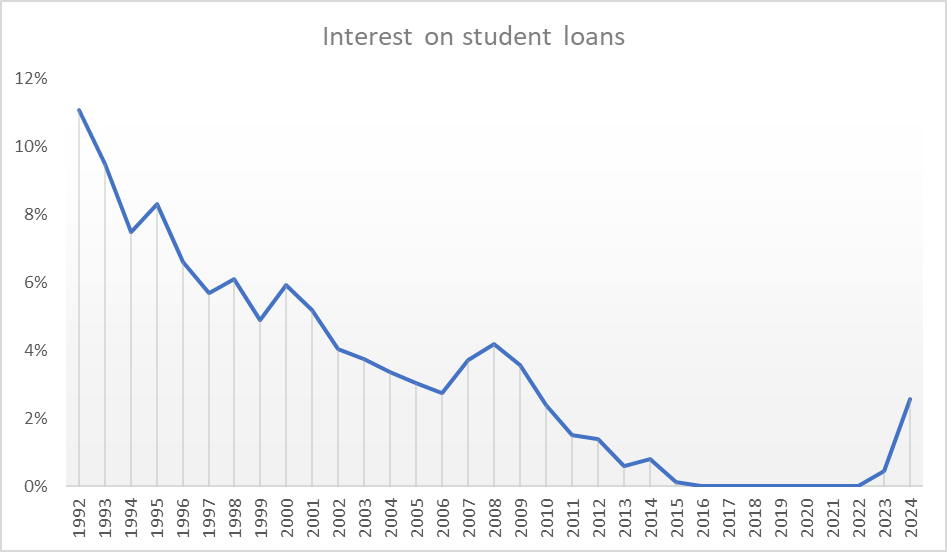

For years, students in the Netherlands paid no interest at all on student loans. The rate was raised to 0.46 percent in 2023 and now another raise has been announced in 2024: 2.56 percent.

The news has been met with widespread disbelief: life is expensive enough as it is, so why charge interest from students? How high can the interest rate go? How much more will students be paying? The Q&A below answers these questions and more.

What are interest rates?

Basically, it costs money to borrow money. If you borrow 100 euros at an interest rate of 1 percent and don’t make any payments, a year later your debt will amount to 101 euros.

I’m still studying. Will I be affected by this higher interest rate?

You’re not paying off your student loans yet, which means you will not notice any immediate effects, but your total debt will grow at a faster rate. If you’ve borrowed 10,000 euros, for example, your debt will grow to 10,256 euros over the next year – a fairly significant increase.

2.56 percent? That must be a record!

It could be much worse. In 2008, the interest rate exceeded 4 percent and, in 1992, it was more than 11 percent. So, there’s no telling in which direction things are headed – unless the Dutch government intervenes, that is. Until the 1980s, students from low-income families were entitled to interest-free student loans.

Image: HOP

How long do I have to pay off my loans?

You have 35 years to pay off your loans, preceded by a two-year grace period. Moreover, you can put your repayments on hold for a total of five years if you need to. All in all, this means it can take you up to 42 years to pay off your debt. Beware, though: until you pay off your loans in full, interest will accrue.

How much will I have to pay back, including interest?

That depends on the interest rate. If the interest rate is 0 percent, you only pay back what you borrowed. But if your debt is 20,000 euros, a 2.56 percent interest rate means you will end up paying back almost 32,000 euros over 35 years. You can calculate how much you will have to pay back on the website of the Education Executive Agency (DUO).

How much will my monthly repayments be?

Based on the figures mentioned above, your monthly repayments would be 75.55 euros. At a 0 percent interest rate, you would pay 47.62 euros a month, so the difference is almost 30 euros. The Minister of Education, Robbert Dijkgraaf, once pointed out the advantage of high inflation: as money becomes less valuable, the repayment amounts will start to feel smaller and smaller. Cold comfort, perhaps.

I started paying off my loans this year. Will my monthly repayments go up in January?

No, not yet. DUO always fixes the interest rate for five years, so borrowers who are paying off their loans know where they stand. If you started repaying this year, your interest rate is 0.46 percent and will remain this way for another four years. You will not be affected by new interest rates until 2028.

My debt is considerable but my salary is low. Am I in trouble?

If you don’t make a lot of money, you might be unaffected by the new interest rate. That’s because DUO calculates your purchasing power. For example, if your annual income is 40,000 euros, your monthly repayment amount won’t be more than 60.55 euros. This means you would pay back a little under 25,500 euros over 35 years. Any remaining debt would be forgiven, including interest.

What if I start earning more?

If your annual income is 60,000 euros, you will not pay more than 127.22 euros a month. The total amount repaid would be 53,431 euros, even if your debt is higher or the interest rate skyrockets to unprecedented levels. This should give you some idea of how hard you will be hit by the interest rate increase. Things do get a bit more complicated if there’s a partner involved, as this may mean there are two incomes and two student debts to repay. It’s possible that, sometime in the future, you will have to repay your partner’s debt, or vice versa. If you have children, this will also affect the calculation.

It costs money to borrow money. Why are student organisations and opposition parties so angry about this increase?

In 2015, the basic student grant was abolished based on the argument that it would be easy for students to repay their loans because they would go on to earn good salaries. VVD, PvdA, D66 and GroenLinks – the parties responsible for introducing the student loan system – were convinced that students just needed to get over their fear of borrowing money. Now, almost a decade later, all four parties have embraced the return of the basic student grant, but it’s the unlucky generation of students who have to pay the price for their experiment. They have higher debts, which also means the new interest rate increase will hit them harder.

Why don’t they just scrap interest on student loans?

Interest rates are linked to five-year government bonds. The Dutch state is able to borrow money at low-interest rates. For a while, the Netherlands even got a negative interest rate: the government was given money when it borrowed money. The interest rate for students was 0 percent. But now that interest rates are rising across the board, students are feeling the effects.

But that’s still a political choice, right?

Speaking to the House of Representatives, Minister Dijkgraaf said the following: “I can imagine that the announced interest rate increase raises a lot of concerns. But capping the interest rate would cost hundreds of millions – perhaps even billions – of euros. That’s money we will not be able to spend on education.”

So, he’s not going to do anything about this?

No. Since the cabinet resigned earlier this year, Minister Dijkgraaf believes it is up to the next government to decide on this matter. He will have his ministry crunch the numbers to figure out what it would cost to cap or scrap interest rates but he warns that these would be expensive interventions, especially given the current economic headwinds and pressure on the government budget.