Student loans

'How much will I pay if interest rates go up?'

Right now, students eligible for a student loan from Dutch organisation DUO don’t pay any interest. But interest rates are climbing again, leading students to wonder how big of a blow they can expect. Well, it all depends on your income and how much you owe.

Please remind me how interest works.

It costs money to borrow money. If you borrow 100 euros at an interest rate of 1 percent and don’t make any payments, your debt will be 101 euros after a year.

But you pretty much have to pay back a student loan.

In the past, students were given 15 years to pay off their debts, but now they get 35 years. Interest will be added for as long as your debt is outstanding.

How much do you have to pay back when you add it all up?

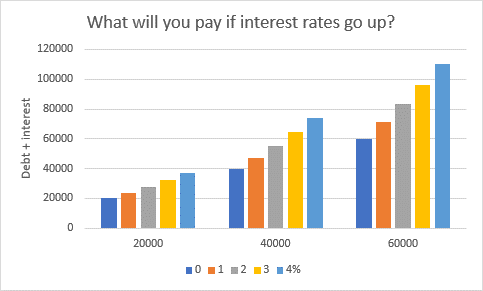

That depends on the interest rate. If the interest rate is 0 percent, you only pay back what you borrowed. But if the rate is 4 percent, over the years you will pay back nearly double the amount. The graph below shows how that works out for a student debt of 20,000, 40,000 and 60,000 euros.

Image: HOP

Image: HOP

What will the monthly bill look like?

Imagine you have 20,000 euros in student debt and a repayment period of 35 years. If interest rates are 0 percent, your monthly payment will be 48 euros. That becomes 66 euros if interest rates rise to 2 percent.

Wow, it goes up fast.

At 4 percent, it jumps to 88 euros a month, and at 5 percent...

Hang on! How am I supposed to pay for that?

That’s a good point. If your income is below a certain threshold, you don’t have to repay the whole amount. You are charged according to your ability to repay.

Sounds reasonable. Can you give me an example?

Let’s say you remain single your whole life, never have children and earn 40,000 euros a year. Using DUO’s tool you can calculate your maximum monthly payment. That comes to 61.89 euros. Over 35 years you will then pay 26,000 euros. All the debt and interest above that amount will be written off.

But I want to earn more.

For an income of 60,000 euros, you won’t pay more than 128.56 euros a month, which means that over 35 years you would pay a total of 54,000 euros. You can use this tool to see how hard you will be hit by interest rate hikes.

I want a partner and children.

A partner means two incomes and two student debts to repay. It’s possible that, sometime in the future, you may have to repay your partner’s debt or vice-versa. Your joint ability to pay will also vary, and you might have to deal with changes to the repayment regulations.

How does DUO calculate my ability to pay back my loan?

If you only earn minimum wage, you don’t have to pay anything back. If you’re single and without children, then you won’t pay more than 4 percent of your income above the minimum wage. If you have a partner or children, then you only have to make repayments if your joint income is above 143 percent of the minimum wage. These are the regulations from 2018.

What is the current minimum wage?

For people aged 21 and older, it’s 1,756 euros a month. 143 percent of that is 2,600 euros. That could obviously change over the years.

Will my interest rate stay the same for 35 years?

No, DUO operates on the basis of a five-year fixed interest rate on loans for former students. So every five years your interest rate could rise or fall. The interest rate can change every year while you are a student.

I want to make my own calculation!

As mentioned above, DUO has a tool on its website so that you can estimate your monthly payment. There are lots of other websites where you can find out how to calculate the interest, for example this one.