Statistics Netherlands: less student debt, higher amounts

Inequality grows among students

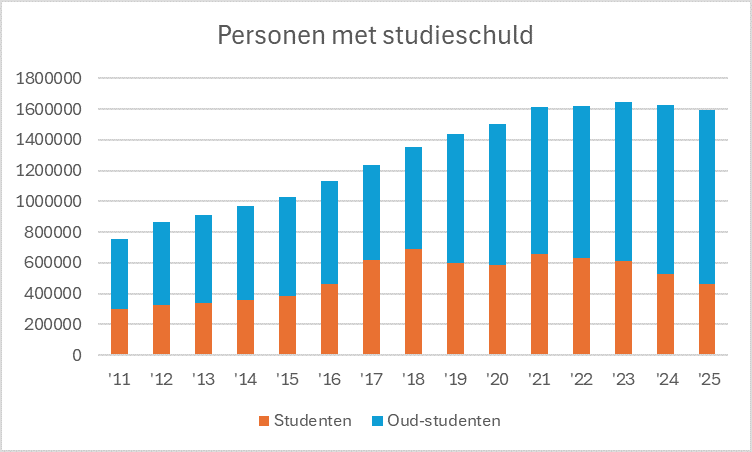

According to the latest figures from Statistics Netherlands (Dutch acronym: CBS), nearly 460,000 students are currently accumulating student debt. These are students who take out a loan in addition to the basic student grant. Lower-income students also receive a supplementary grant in addition to the basic grant.

The number of students incurring student debt is lower than in the peak year of 2021, when 657,000 students in vocational, higher professional and university education had student debt. On the other hand, the number of graduates in debt continues to grow: there are now 1.1 million of them.

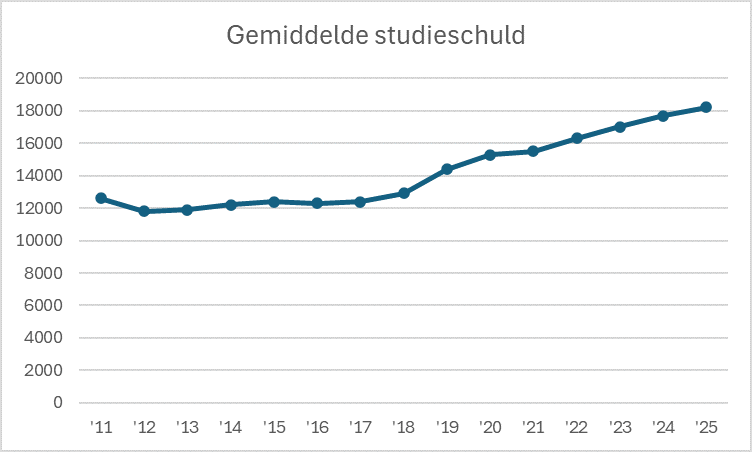

However, the average student debt in the Netherlands continues to rise. It now stands at more than 18,000 euros. The rapid increase did not occur immediately in 2015 when the basic grant was abolished and a new loan system was introduced. After all, the basic grant was only abolished for new students. Those who were already enrolled at the time were not affected. Therefore, it took some time for the consequences to become apparent. The basic grant was reintroduced in September 2023, the effect of which will also increase in later years.

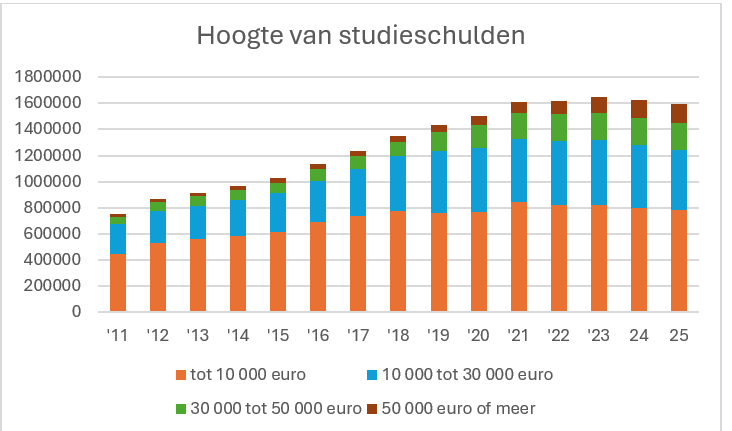

Almost half of the students with debts owe less than 10,000 euros. Another 29 per cent owe no more than 20,000 euros. However, many people have contracted significantly higher student debts: 13 per cent must repay between 30,000 euros and 50,000 euros, and another 9 per cent owe even more than that.

'It is good that fewer students need to borrow money now', says Sarah Evink, chair of the National Student Association (ISO). However, she believes that the figures also indicate an increase in inequality among students, which she finds worrisome. ‘It is distressing that so many people have student debts of over 50,000 euros.’ She fears that such high debts will deter young people from continuing their studies.

Students can spread the repayment of their student debt over 35 years. They can also suspend repayments for five years if they wish. They repay the government according to their means: if they have a low income, the monthly repayment is capped. The remaining debt is written off after 35 years. The interest rate was kept at zero per cent for years, but it has since risen.

Given the relatively favourable conditions, some students might borrow the maximum amount and use the money to obtain a lower mortgage from the bank when they buy a house. CBS does not know how many students are doing this.

The debate around student debt usually focuses on the other side of the coin: when banks consider student debt when deciding to lend someone a mortgage, which makes it difficult for students and recent graduates to buy a house. Politicians facilitate the concealment of student debts when purchasing a house, despite calls from various authorities not to do so.

Comments

We appreciate relevant and respectful responses. Responding to DUB can be done by logging into the site. You can do so by creating a DUB account or by using your Solis ID. Comments that do not comply with our game rules will be deleted. Please read our response policy before responding.